Mortgage interest tax deduction 2020 calculator

On a 15-year fixed mortgage the average rate is 514. Ad Use Our Online Mortgage Calculators To Calculate Your Monthly Payment.

Can I Get A Student Loan Tax Deduction The Turbotax Blog

Since April 2020 youve no longer been able to.

. Limits on Home Mortgage Interest Deduction later. A document published by the Internal Revenue Service IRS that provides information on deducting home mortgage interest. IRS Publication 936.

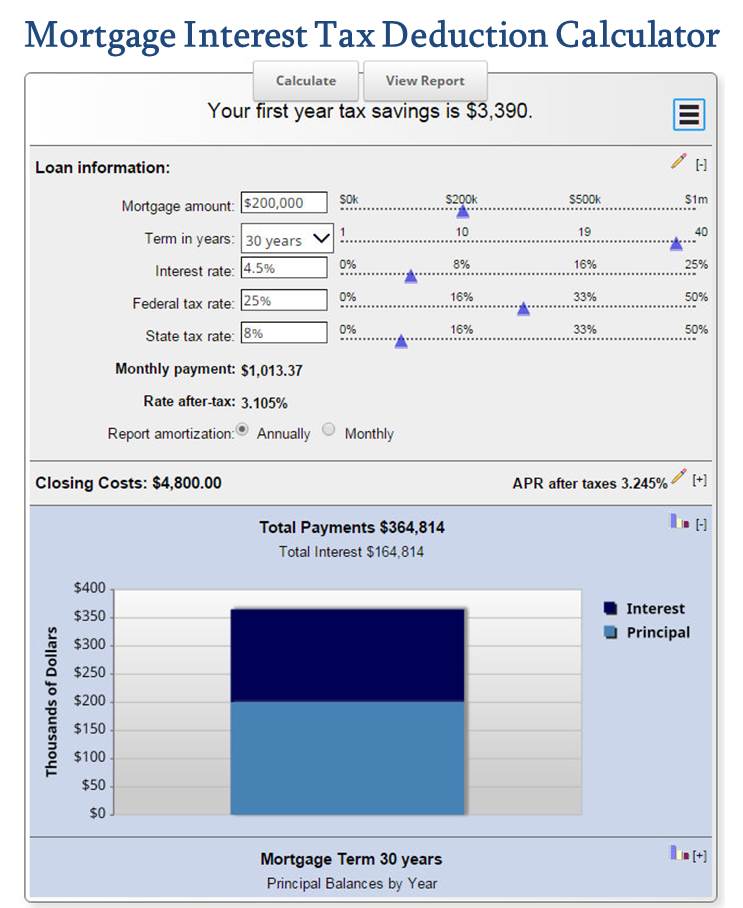

TaxInterest is the standard that helps you calculate the correct amounts. Mortgage Tax Deduction Calculator. Ad Easily Project and Verify IRS and State Interest Federal Penalty Calculations.

Costs calculated on 25 of finance. Home Uncategorized mortgage interest tax deduction 2020 calculator. Limits on Home Mortgage Interest Deduction later.

The Sales Tax Deduction Calculator. The tax reduction is. Use this calculator to see how.

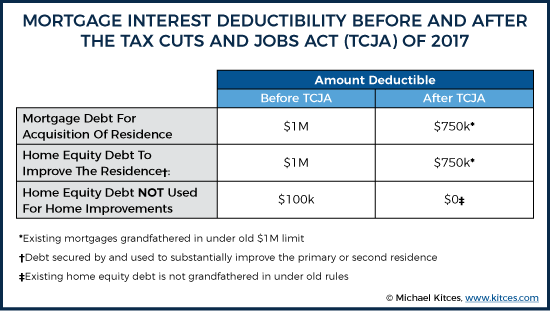

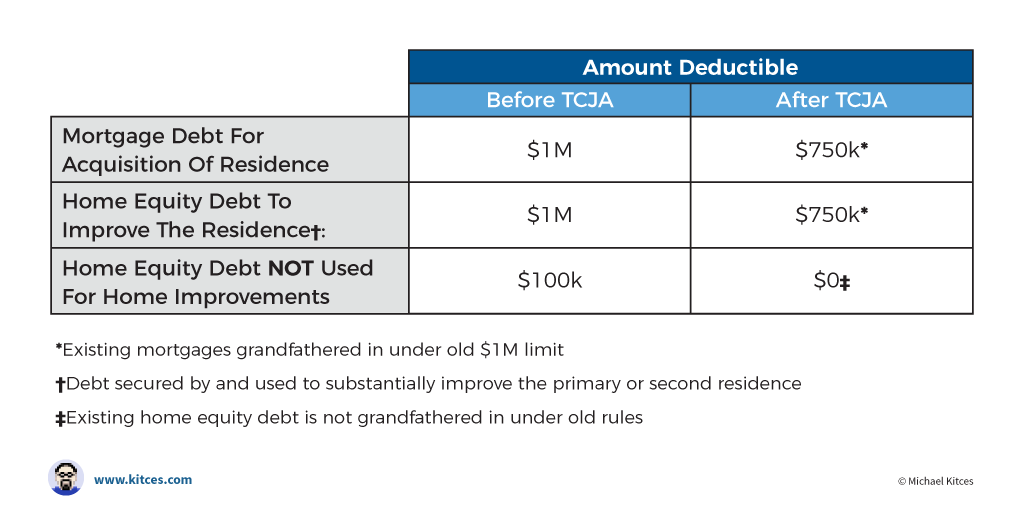

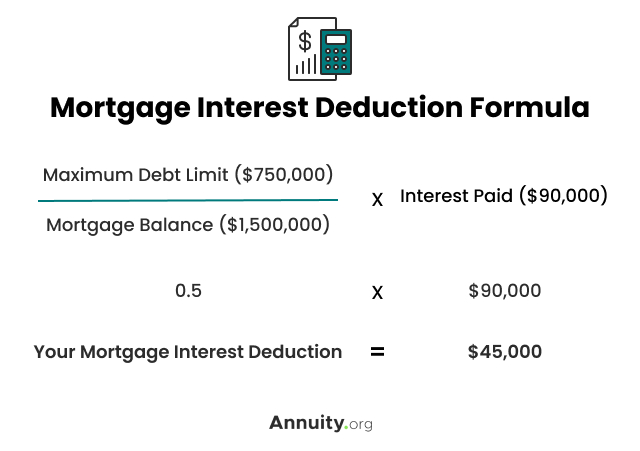

The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on home loans up to 750000. For taxpayers who use married filing separate. You can deduct home mortgage interest on the first 750000 375000 if married filing separately of.

Use this calculator to see how much. The interest paid on a. Throughout the course of your mortgage the interest on your mortgage.

Less 20 tax reduction for remaining finance. Costs 8000 x 25 2000 x 20 -400. However the statement shouldnt show any interest that was paid for you by a government agency.

877 948-4077 call Schedule a Call. Ad The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns. IRS Publication 936.

Final Income Tax 3300. Home Uncategorized mortgage interest tax deduction 2020 calculator. The interest you pay on your mortgage or any points you paid when you took out your loan could be tax deductible.

Mortgage Tax Savings Calculator. However higher limitations 1 million. You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebt-edness.

Mortgage Tax Deduction Calculator The interest you pay on your mortgage or any points you paid when you took out your loan could be tax deductible. Ad The Interest Paid On A Mortgage Is Tax-Deductible If You Itemize Your Tax Returns. Use the mortgage tax savings calculator to determine how much your mortgage payments could reduce your income taxes.

Discover Helpful Information And Resources On Taxes From AARP. Mortgage interest is tax-deductible on mortgages of up to 750000 unless the mortgage was taken out before December. Use this calculator to see how.

Interest on up to 750000 in mortgage debt is tax deductible provided the mortgage debt is obtained via origination debt or the debt is taken on to build or substantially improve the.

Mortgage Tax Deduction Calculator Homesite Mortgage

Are Medical Expenses Tax Deductible

Mortgage Interest Tax Deduction Calculator Mls Mortgage

Mortgage Interest Tax Deduction Calculator Mls Mortgage

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551427/distribution_repeal_SALT.png)

The State And Local Tax Deduction Explained Vox

Home Ownership Tax Benefits Mortgage Interest Tax Deduction Calculator

Laugh For The Day Tax Deduction In 2022 Crazy Cats Cat Jokes Funny Cats

Tax Deductions For Home Mortgage Interest Under Tcja

The Best Home Office Deduction Worksheet For Excel Free Template

Mortgage Tax Deduction Calculator Freeandclear

Understanding The Mortgage Interest Deduction The Official Blog Of Taxslayer

Mortgage Interest Tax Deduction Guide Nextadvisor With Time

Tax Deductions For Home Mortgage Interest Under Tcja

Home Office Tax Deductions Faqs Bench Accounting

Mortgage Interest Tax Deduction What Is It How Is It Used

The Big Fat List Of Small Business Tax Deductions For 2021 Accountable Cfo

Mortgage Interest Deduction Or Standard Deduction Houselogic